Get ready for the next Bitcoin Halving in 2024 – a pivotal event that could reshape the future of cryptocurrency.

The concept of Bitcoin Halving has long been an integral part of the cryptocurrency ecosystem, shaping the dynamics of this digital asset. With its upcoming occurrence in 2024, the anticipation surrounding this event is palpable.

The implications of Bitcoin Halving extend beyond mere market fluctuations; they delve into the very core of how Bitcoin operates and its future trajectory.

This event has the potential to trigger significant changes in the Bitcoin landscape, making it a subject of intense scrutiny and speculation among enthusiasts and experts alike.

What is Bitcoing Halving

Bitcoin halving is a pivotal event in the cryptocurrency space that occurs approximately every four years, marking a significant reduction in the rewards miners receive for validating transactions on the blockchain.

This reduction cuts the block rewards in half, impacting miners’ profitability.

The aim is to control the supply of new bitcoins and promote sustainable growth within the network, shaping the future trajectory of the cryptocurrency.

Statistics on Bitcoin Halving:

here are some key statistics related to Bitcoin halving:

- Halving Schedule: Bitcoin halving occurs approximately every four years, or after every 210,000 blocks are mined.

- Block Reward Reductions:

- The first halving on November 28, 2012, reduced the block reward from 50 BTC to 25 BTC.

- The second halving on July 9, 2016, reduced the block reward from 25 BTC to 12.5 BTC.

- The third halving on May 11, 2020, reduced the block reward from 12.5 BTC to 6.25 BTC.

- The fourth halving, expected in April 2024, will reduce the block reward from 6.25 BTC to 3.125 BTC.

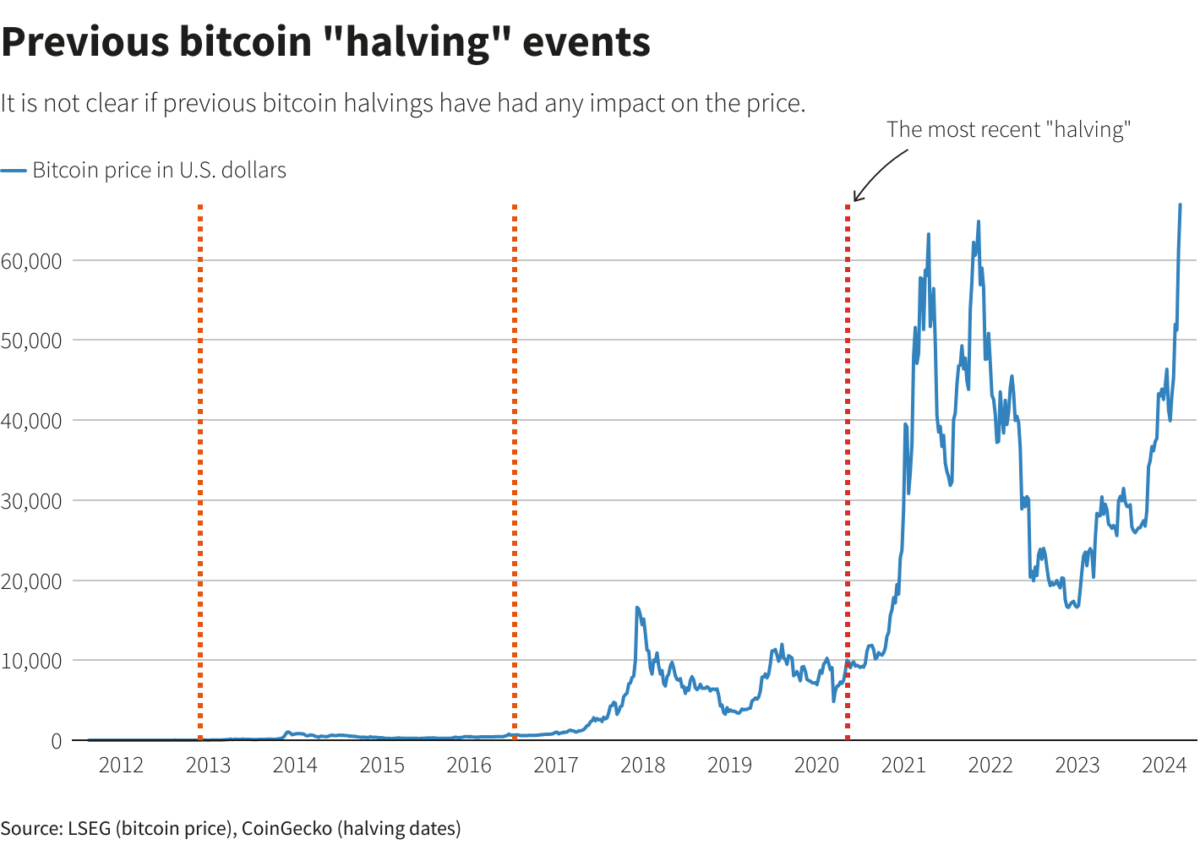

- Bitcoin Price at Halving:

- At the first halving in 2012, the BTC price was approximately $12.4.

- At the second halving in 2016, the BTC price was approximately $680.

- At the third halving in 2020, the BTC price was approximately $8,590.

- The price for the fourth halving in 2024 is not available as it has not occurred yet.

- Bitcoin Price Fluctuations:

- The highest price in the first halving cycle (November 2012 – July 2016) was $1,170.

- The highest price in the second halving cycle (July 2016 – May 2020) was $19,400.

- The highest price in the third halving cycle (May 2020 – April 2024) was $73,628 as of April 4, 2024.

- Percentage Increase Around Halvings:

- Halving 1 (2012): +385% 12 months before the halving, and 5,089% in the year after.

- Halving 2 (2016): +142%, and 284% in the year after.

- Halving 3 (2020): +17%, and 559% in the year after.

- Supply Milestones:

- By the time of the next Bitcoin halving in April 2024, 93.7% of the total Bitcoin supply will have been mined.

- The maximum supply cap for Bitcoin is 21 million, and the halving events are designed to ensure that this cap is not exceeded.

- Stock-to-Flow Model: The concept of “stock-to-flow” measures the existing supply of a commodity relative to the new supply entering the market. This model is often used to analyze the impact of halving on Bitcoin’s value.

Overview

Here is a summary of the key information from the article in a table format:

| Topic | Summary |

|---|---|

| What is Bitcoin Halving? | – Bitcoin halving is an event that occurs approximately every 4 years, where the block reward for miners is reduced by 50%. – This mechanism is designed to control the supply of new bitcoins entering circulation and promote sustainable growth within the network. |

| Bitcoin Halving Statistics | – Halving Schedule: Every 210,000 blocks mined (around 4 years) – Block Reward Reductions: 50 BTC -> 25 BTC -> 12.5 BTC -> 6.25 BTC -> 3.125 BTC – Bitcoin Price at Halving: $12.4 (2012), $680 (2016), $8,590 (2020) – Percentage Increase Around Halvings: 385% (2012), 142% (2016), 17% (2020) |

| The Mining Process | – Miners validate transactions and add new blocks to the blockchain. – Miners are rewarded with newly minted bitcoins (block rewards) for their efforts. – Block rewards decrease by 50% during each halving event. |

| Implications of Bitcoin Halving | – Potential impact on market dynamics, Bitcoin’s supply, and miner profitability. – Theories on how halving affects Bitcoin’s price, including historical price movements. – Challenges for miners, including adjustments needed to remain profitable and potential for increased centralization. |

| Bitcoin Halving and Market Dynamics | – Scarcity and its effect on Bitcoin’s value. – Demand trends and speculative behavior around halving events. – Halving as a potential investment catalyst, with risks and considerations for investors. |

| Environmental Considerations | – Debate over Bitcoin mining’s environmental impact, particularly energy consumption. – Changes in energy consumption post-halving and the push for more sustainable mining practices. |

Historical Context

Bitcoin’s halving events, occurring approximately every four years, have played a crucial role in controlling the issuance of new bitcoins.

These events, marked by a reduction in block rewards, aim to promote sustainability and regulate the supply of this digital asset, influencing market dynamics and investor behavior.

The Mechanics of Bitcoin Halving

Bitcoin halving occurs approximately every four years, reducing the block rewards by half.

This mechanism is designed to control the supply of new bitcoins entering circulation, ensuring a gradual release and promoting long-term network growth and stability.

Bitcoin halving events play a significant role in shaping the behavior of miners and investors in the cryptocurrency market. The reduction in block rewards incentivizes miners to operate more efficiently and sustainably, as their profit margins are directly impacted.

Additionally, the scarcity of new bitcoins introduced through halving events often leads to increased demand from investors, potentially driving up the price of Bitcoin in the long term.

The Mining Process

Bitcoin mining is the process by which new bitcoins are created and added to the circulating supply. Miners play a crucial role in validating transactions and securing the Bitcoin network.

As a reward for their efforts, miners receive block rewards in the form of newly minted bitcoins.

How Bitcoin mining works

The process of Bitcoin mining involves validating transactions and adding them to the blockchain through complex computational tasks.

- Miners compete to solve mathematical puzzles.

- The first miner to solve the puzzle adds a new block to the blockchain.

- This process requires substantial computational power and energy consumption.

The role of miners in the Bitcoin network

Miners in the Bitcoin network play a critical role in validating transactions and ensuring the security and integrity of the blockchain through their computational efforts. They use specialized hardware to solve complex mathematical problems, adding new blocks to the blockchain.

This process secures the network against fraud and double-spending. Miners also receive rewards in the form of newly minted bitcoins for their contributions to maintaining the network.

The concept of block rewards

With the essential role of miners established in validating transactions and maintaining blockchain security, the concept of block rewards serves as a fundamental incentive mechanism within the mining process.

- Miners receive block rewards for successfully adding new blocks to the blockchain.

- Block rewards consist of newly created bitcoins and transaction fees.

- The reward amount decreases by half approximately every four years through the halving process.

Halving Events

Bitcoin halving events occur approximately every four years, reducing block rewards by 50% each time. These events follow a predictable schedule, happening every 210,000 blocks mined.

The schedule of Bitcoin halving events (every 210,000 blocks)

The recurring Bitcoin halving events, occurring every 210,000 blocks, serve as pivotal milestones in the cryptocurrency’s supply mechanism.

- Each halving event signifies a reduction in block rewards, impacting miners and the overall Bitcoin ecosystem.

- The schedule of halving events ensures a controlled release of new bitcoins into circulation.

- These events play a crucial role in maintaining the scarcity and value proposition of Bitcoin.

The reduction of block rewards by 50% during each halving

During each Bitcoin halving event, there is a notable reduction of 50% in block rewards, significantly impacting miners and the overall ecosystem of the cryptocurrency. This reduction cuts the rewards miners receive for validating transactions in half, affecting their profitability.

The halving events play a crucial role in regulating the issuance of new bitcoins and maintaining the economic balance within the Bitcoin network.

Historical halving dates and block rewards

Historical halving events in the cryptocurrency space have been pivotal moments that significantly impact miners and the overall ecosystem.

- Bitcoin halving occurs every 210,000 blocks, reducing new bitcoin issuance.

- The block rewards have decreased from 50 to 25, then to 12.5, and finally to 6.25 bitcoins per block.

- The next halving is projected to occur in 2024, reducing rewards to 3.125 bitcoins per block.

Implications of Bitcoin Halving

Potential Impacts of Bitcoin Halving on Market Dynamics:

Bitcoin halving can disrupt market dynamics by reducing miner rewards, affecting profitability and industry viability. This scarcity mechanism may drive long-term price appreciation due to decreased supply.

Post-halving effects on miner operations, particularly smaller entities, could lead to challenges in remaining competitive. Additionally, market participants may witness altered supply-and-demand dynamics, potentially influencing long-term price trends.

On Bitcoin’s Supply

Bitcoin’s supply dynamics play a crucial role in shaping the cryptocurrency’s ecosystem. With the halving event reducing the rate of new Bitcoin creation, the total supply cap of 21 million looms closer, emphasizing scarcity and potential value appreciation.

As block rewards diminish, miners will increasingly rely on transaction fees, altering the incentive structure within the Bitcoin network.

The impact on the rate of new Bitcoin creation

The halving events in the Bitcoin network significantly impact the rate at which new Bitcoin is created, thereby influencing the overall supply of the digital currency.

- Halving reduces the rate of new Bitcoin issuance.

- This mechanism ensures a controlled and predictable creation of new coins.

- The decreased rate of new Bitcoin creation contributes to the scarcity and value proposition of the cryptocurrency.

Bitcoin’s maximum supply cap of 21 million

Bitcoin’s total supply is capped at 21 million coins. This limit is hardcoded into Bitcoin’s protocol, ensuring a finite number of coins will ever be in circulation.

The scarcity created by this cap is a fundamental aspect of Bitcoin’s value proposition, as it contrasts with traditional fiat currencies that can be endlessly printed.

This feature is designed to maintain the purchasing power of Bitcoin over time and prevent inflation.

The transition from block rewards to transaction fees as rewards for miners

As the mining ecosystem evolves, a gradual shift is observed from reliance on block rewards towards transaction fees as the primary source of revenue for miners.

Miners are increasingly focusing on transaction fees for revenue.

This transition is driven by halving events reducing block rewards.

Efficient management of transaction fees becomes crucial for miner profitability.

On Bitcoin’s Price

Bitcoin’s price dynamics post-halving are a subject of keen interest and speculation among investors and analysts alike. Historical patterns suggest that halving events have led to significant price movements in the past, with bear markets often preceding bullish trends.

Expert opinions on the impact of halvings on Bitcoin’s price, combined with theories on supply dynamics and market sentiment, provide valuable insights for understanding the potential effects of future halving events.

Theories on how halving affects Bitcoin’s price

The impact of the halving event on Bitcoin’s price is a subject of various theories and speculations within the cryptocurrency community.

- Some believe halving reduces selling pressure from miners.

- Others suggest scarcity post-halving drives up demand.

- Certain analysts argue halving’s psychological impact influences investor behavior.

Historical price movements post-halving events

Historical price movements following Bitcoin halving events have been a focal point of analysis and speculation within the cryptocurrency community. Past halvings have often been associated with significant price surges in the months that follow.

While historical data indicates an upward trend in Bitcoin’s price post-halving, it is essential to consider other market factors that can influence price movements, such as investor sentiment, regulatory developments, and broader economic conditions.

Expert opinions and predictions for future halvings

Analysts and experts in the cryptocurrency space offer valuable insights and projections regarding future Bitcoin halving events and their potential impacts on price dynamics.

- Analysts predict increased investor interest and scarcity dynamics driving price surges post-halving.

- Speculation on potential price hikes following halving events based on historical trends.

- Ongoing regulatory changes and market dynamics may shape future bitcoin price movements.

On Miners

Discussing the impact of Bitcoin halving on miners involves analyzing changes in mining profitability post-halving, understanding the adjustments miners need to make to remain profitable, and considering the potential for increased mining centralization.

As the block rewards are halved, miners face reduced income, prompting them to optimize their operations and explore alternative revenue streams.

This shift could lead to a concentration of mining power in the hands of larger, more resourceful mining operations, potentially affecting the decentralization of the Bitcoin network.

Changes in mining profitability post-halving

Following the Bitcoin halving event of 2024, the mining profitability landscape experienced significant shifts due to the reduction in block rewards.

- Miners faced a 50% reduction in rewards, impacting their revenue streams.

- Smaller mining operations encountered challenges in maintaining profitability.

- Larger miners with resources to adapt to the changes had a competitive advantage.

Adjustments miners have to make to remain profitable

After the Bitcoin halving event of 2024, miners are required to implement strategic adjustments to their operations in order to maintain profitability amidst the reduced block rewards. These adjustments may include:

- Upgrading hardware to increase efficiency

- Seeking out lower-cost energy sources

- Optimizing operational processes to reduce expenses

Miners will also need to focus on:

- Maximizing transaction fee revenues

- Exploring innovative revenue streams to adapt to the changing landscape of reduced block rewards.

The potential for increased mining centralization

The evolution of blockchain technology post the 2024 Bitcoin halving event raises concerns about the potential for increased mining centralization among industry stakeholders.

- Larger mining operations may gain dominance, impacting decentralization efforts.

- Smaller miners could face challenges competing with more significant players.

- Centralization risks may arise if a few entities control a significant portion of the mining power.

Bitcoin Halving and Market Dynamics

Exploring the intricate interplay between Bitcoin halving events and market dynamics reveals the underlying forces shaping cryptocurrency valuations and investor behavior. Bitcoin halving impacts supply and demand dynamics, potentially leading to price fluctuations.

Post-halving, market participants closely monitor price movements, trading volumes, and investor sentiment. Understanding these market dynamics is crucial for assessing the broader implications of Bitcoin halving events on the cryptocurrency landscape.

Supply and Demand

The dynamics of supply and demand play a crucial role in shaping Bitcoin’s value. Scarcity, a key feature of Bitcoin due to halving events, influences its perceived worth.

Additionally, shifts in demand patterns around halving events reflect speculative behavior and market expectations, further impacting Bitcoin’s price trajectory.

The concept of scarcity and its effect on Bitcoin’s value

In understanding Bitcoin’s value dynamics, the concept of scarcity plays a pivotal role in shaping its market demand and price fluctuations.

- Bitcoin’s limited supply of 21 million coins creates scarcity.

- Scarcity drives up demand as more investors seek to own a piece of the finite asset.

- The diminishing block rewards through halving events further enhance Bitcoin’s scarcity, potentially increasing its long-term value.

Demand trends for Bitcoin around halving events

Around Bitcoin halving events, market demand for the cryptocurrency often experiences notable fluctuations in response to changes in its supply dynamics.

The reduction in new bitcoins entering circulation due to halving increases scarcity, potentially driving long-term upward pressure on Bitcoin’s price.

Investors closely monitor these events, anticipating how the decreased supply will impact the market, influencing trading volumes and investor sentiment around these key milestones.

Speculative behavior and market anticipation

During Bitcoin halving events, speculative behavior and market anticipation play significant roles in shaping supply and demand dynamics within the cryptocurrency ecosystem.

Investors closely monitor halving news for potential price shifts.

Speculators may increase trading activity leading up to and following halving events.

Anticipation of reduced supply post-halving can drive up demand and influence market sentiment.

Investment Perspective

When considering the investment perspective of Bitcoin halving, it’s crucial to view halving as a potential catalyst for investment opportunities. Investors should carefully assess the risks and considerations associated with the volatile nature of the cryptocurrency market.

Understanding the differences between long-term and short-term investment strategies is essential for navigating the dynamic landscape of Bitcoin halving events.

Halving as a potential investment catalyst

Periodically, the Bitcoin halving event serves as a pivotal investment catalyst, impacting market dynamics and investor sentiments.

- Bitcoin halving historically precedes price surges, attracting investor attention.

- Reduced supply post-halving may increase demand, potentially driving up prices.

- Investors often anticipate halving events, adjusting portfolios to capitalize on potential gains.

Risks and considerations for investors

The Bitcoin halving event is historically viewed as a catalyst for investment opportunities. However, it comes with inherent risks and considerations that investors must carefully evaluate from an investment perspective.

Volatility in Bitcoin’s price pre and post-halving, regulatory changes, market sentiment shifts, and competition among miners for reduced rewards are key factors to assess.

Investors should prioritize thorough research and risk management strategies in light of these dynamics.

Long-term versus short-term investment strategies

Exploring the optimal investment horizon: is it wiser to focus on long-term growth or short-term gains in the context of Bitcoin halving events?

- Long-term strategies may benefit from the scarcity-driven price appreciation post-halving.

- Short-term tactics could capitalize on immediate price fluctuations surrounding the event.

- Balancing both approaches could offer a diversified investment portfolio for risk mitigation.

Environmental Considerations

Environmental sustainability is a critical aspect to consider in the context of Bitcoin halving events. The energy-intensive nature of Bitcoin mining raises concerns about its environmental impact, particularly in terms of electricity consumption.

As the mining process becomes more challenging post-halving, miners may seek energy-efficient solutions to mitigate their carbon footprint. Balancing profitability with environmental responsibility is crucial for the long-term sustainability of Bitcoin mining operations.

Energy Consumption

The energy consumption of Bitcoin mining has been a topic of debate, especially concerning its environmental impact. Changes in energy consumption post-halving events can significantly influence the sustainability of mining operations.

This has led to a growing push within the industry towards adopting more sustainable mining practices to mitigate environmental concerns.

The debate over Bitcoin mining’s environmental impact

Debate surrounds the environmental impact of Bitcoin mining, particularly concerning energy consumption levels.

- Bitcoin’s energy consumption has sparked concerns about carbon footprints.

- Critics argue that mining operations contribute to global warming.

- Proponents highlight the potential for renewable energy use in mining processes.

Changes in energy consumption post-halving

Following the recent Bitcoin halving event of 2024, notable changes in energy consumption post-halving have become a focal point of analysis within the cryptocurrency community.

The reduction in block rewards could lead to increased competition among miners, potentially driving them to seek more energy-efficient solutions.

This shift may prompt a reevaluation of mining operations to optimize energy consumption and sustainability in the post-halving landscape.

The push towards sustainable mining practices

In the evolving landscape of cryptocurrency mining, there is a growing emphasis on adopting sustainable practices to address energy consumption concerns.

- Implementing renewable energy sources like solar and wind power.

- Utilizing energy-efficient mining hardware and cooling systems.

- Exploring innovative solutions such as energy recapture technologies for mining operations.

The Future of Bitcoin Halving

As the cryptocurrency landscape continues to evolve, the future trajectory of Bitcoin halving events remains a focal point for industry stakeholders and investors alike. Market analysts anticipate potential price increases and trading volume surges following halving events, driven by increased investor interest and scarcity dynamics.

Ongoing developments in the crypto industry, coupled with regulatory changes and market dynamics, will continue to shape the future outlook for bitcoin and digital assets.

Remaining Halvings

As the Bitcoin halving events progress, the countdown to the final halving in 2140 becomes increasingly significant. This milestone raises questions about what will occur when the last Bitcoin is mined and how it might impact the broader Bitcoin ecosystem.

Understanding the potential implications of these remaining halvings is crucial for grasping the long-term sustainability and dynamics of the cryptocurrency.

The countdown to the final Bitcoin halving in 2140

The final Bitcoin halving scheduled for 2140 marks the culmination of the series of halving events that progressively reduce new coin issuance in the Bitcoin network.

- It signifies the end of the halving process that started with the creation of Bitcoin.

- This event will set the total supply of bitcoins at 21 million.

- Miners will shift to earning transaction fees entirely, shaping the network’s future dynamics.

What happens when the last Bitcoin is mined

Upon reaching the final Bitcoin to be mined, subsequent halving events will lead to a gradual reduction in block rewards until miners rely solely on transaction fees for revenue.

As the remaining halvings unfold, the diminishing block rewards will increasingly shift the mining industry’s focus towards transaction fees.

This transition marks a pivotal moment in the evolution of Bitcoin’s economic model and the sustainability of its ecosystem.

The potential impact on the Bitcoin ecosystem

What significant shifts in the Bitcoin ecosystem can be anticipated as the remaining halving events approach?

- Miners may face increased pressure on profitability.

- Smaller mining operations might find it challenging to compete.

- Larger miners with better resources could consolidate their position in the industry.

Technological and Regulatory Developments

Recent advancements in mining technology have revolutionized the efficiency and operations within the industry.

Regulatory changes have also played a pivotal role in shaping the trajectory of Bitcoin and the impact of halving events.

The evolving landscape of cryptocurrency and digital assets continues to be influenced by technological innovations and regulatory frameworks, highlighting the dynamic nature of the industry.

Innovations in mining technology and efficiency

The advancements in mining technology and efficiency within the cryptocurrency industry have significantly transformed the landscape for miners and investors alike.

- Introduction of more energy-efficient ASIC miners.

- Implementation of innovative cooling systems to enhance mining operations.

- Development of mining pools for improved collective processing power.

The influence of regulatory changes on Bitcoin and halving

Amidst the evolving landscape of the cryptocurrency industry, regulatory changes play a pivotal role in shaping the trajectory of Bitcoin and its halving events.

These changes can impact investor sentiment, market stability, and the overall adoption of Bitcoin.

Understanding and adapting to regulatory shifts are essential for the sustainable growth and success of Bitcoin in the long term.

The evolving landscape of cryptocurrency and digital assets

Within the dynamic realm of digital assets and cryptocurrencies, ongoing technological advancements and regulatory developments are reshaping the landscape and influencing market dynamics.

- Blockchain technology continues to evolve, enhancing security and scalability.

- Regulatory bodies worldwide are working to establish clear guidelines for crypto transactions.

- DeFi platforms are gaining traction, offering decentralized financial services and challenging traditional banking systems.

How Much Is Bitcoin Worth Now?

With Bitcoin’s current value hovering around $65,000, the cryptocurrency market continues to attract significant attention from investors and analysts alike. This price stability post-halving indicates a robust market sentiment towards Bitcoin.

The consistent valuation at this level showcases a strong investor belief in the digital asset’s long-term potential. As Bitcoin maintains its value, it reinforces its position as a leading player in the cryptocurrency landscape.

How Does This Affect Miners?

The impact of the recent Bitcoin halving event on miners’ profitability and operational viability has prompted a reassessment of revenue streams and operational strategies in the mining sector.

- Miners need to find alternative revenue sources.

- Profitability may decrease due to reduced rewards.

- Operational efficiency and cost management become crucial.

What To Watch Out For in the Next Few Months

As we move forward into the next few months, anticipation grows for potential shifts in the cryptocurrency market landscape. Investors and analysts are keenly observing Bitcoin’s price movement post-halving, looking for signs of stability or volatility.

Additionally, the impact of regulatory changes, market trends, and institutional adoption on Bitcoin’s value will be closely monitored. Keep an eye on trading volumes and investor sentiment for insights into the market’s direction.

Is Bitcoin More Volatile Now?

Increased market uncertainties have underscored the question of Bitcoin’s current volatility levels.

- Bitcoin’s volatility has indeed increased in recent times.

- Factors such as regulatory developments and global economic conditions contribute to this heightened volatility.

- Traders and investors need to closely monitor these fluctuations to make informed decisions in the cryptocurrency market.

What Has Been the Outcome of Previous Halving Events?

Examining the results of past halving events reveals valuable insights into Bitcoin’s price behavior and mining industry dynamics. Previous halvings have historically led to price surges due to decreased supply and increased demand.

Miners, especially smaller operations, may face challenges post-halving with reduced rewards. Larger miners with resources to adapt are better positioned.

Each halving event intensifies competition and impacts the overall mining landscape.

When Is the Next Halving Event?

The upcoming halving event for Bitcoin is highly anticipated, given its historical impact on the cryptocurrency’s price and mining ecosystem.

- The next halving event is projected to occur around mid-April.

- It will reduce the block rewards from 6.25 BTC to 3.125 BTC per mined block.

- This reduction in rewards will have significant implications for miners and the overall supply dynamics of Bitcoin.

How Many Halvings Will There Be?

There will be a total of 64 halvings for Bitcoin, with the final halving expected around the year 2140. Each halving occurs approximately every four years or after every 210,000 blocks mined.

The halving reduces block rewards by half, serving as a crucial mechanism to control the release of new bitcoins into circulation. After the final halving, miners will earn transaction fees as block rewards.

How does Bitcoin halving impact network security and decentralization?

Bitcoin halving has significant implications for network security and decentralization in the Bitcoin ecosystem. The reduction in mining rewards can impact transaction processing times and fees, potentially affecting market participants like investors and traders.

Measures to counter increased mining centralization post-halving and trends in miner behavior around these events are crucial for maintaining the network’s security and decentralization.

What are the potential effects of Bitcoin halving on transaction processing times and fees?

Amidst a Bitcoin halving event, the reduction in mining rewards directly influences transaction processing times and fees, impacting network security and decentralization.

- Transaction processing times may increase due to fewer incentives for miners.

- Transaction fees could rise as miners seek to maintain profitability.

- Network security may be temporarily compromised as miners adjust to lower rewards.

How do halving events influence market participants like investors and traders?

Halving events significantly influence market participants such as investors and traders. These events shape their strategies and decisions in response to the changing dynamics of Bitcoin’s supply and demand.

Traders may anticipate price fluctuations pre and post-halving, adjusting their positions accordingly. Investors might view halving as a signal of scarcity, potentially leading to long-term price appreciation.

What measures can be taken to mitigate risks related to increased mining centralization post-halving?

In light of the potential risks associated with increased mining centralization following the Bitcoin halving event, proactive measures must be implemented to safeguard network security and preserve decentralization.

- Enhanced Mining Pool Diversity: Encourage a more balanced distribution of mining power across various pools to prevent dominance by a few entities.

- Regular Protocol Updates: Implement frequent updates to the Bitcoin protocol to address any emerging centralization threats promptly.

- Community Education: Educate miners and users about the importance of decentralization and its impact on network security to foster a collective commitment to maintaining a decentralized ecosystem.

How does Bitcoin halving affect the perception and adoption of cryptocurrencies in the financial industry?

The impact of Bitcoin halving on the perception and adoption of cryptocurrencies in the financial industry is crucial to understanding the dynamics of network security and decentralization. Halving events affect miner rewards, potentially impacting network security.

As rewards decrease, miners may seek alternative revenue streams, leading to shifts in mining behavior. This can influence decentralization efforts within the cryptocurrency ecosystem.

Are there emerging trends in miner and mining pool behavior around halving events?

Emerging trends in miner and mining pool behavior around Bitcoin halving events reflect evolving strategies to navigate the impact on network security and decentralization in the cryptocurrency ecosystem.

- Miners consolidate resources for efficient operations.

- Mining pools adjust reward structures to incentivize participation.

- Increased focus on renewable energy solutions to address environmental concerns.

What role do halving events play in shaping Bitcoin’s store of value proposition?

Halving events significantly contribute to shaping Bitcoin’s store of value proposition by impacting network security and decentralization dynamics within the cryptocurrency ecosystem.

The reduction in block rewards affects miner profitability, potentially leading to consolidation in the mining sector. Additionally, halving events reinforce Bitcoin’s scarcity model, fostering long-term value appreciation.

Decentralization is bolstered as larger miners with resources navigate post-halving challenges better than smaller operators.

How do geopolitical events and macroeconomic conditions interact with Bitcoin halving to influence market dynamics?

Geopolitical events and macroeconomic conditions intertwine with Bitcoin halving to exert notable influence on market dynamics, particularly affecting network security and decentralization within the cryptocurrency landscape.

Changing regulatory environments post-halving impact miner operations.

Economic instability can drive investors towards Bitcoin, altering market demand.

Halving-induced price fluctuations may incentivize or discourage mining activity.

How can the environmental impact of Bitcoin mining be addressed through technological advancements or policy changes related to halving?

Addressing the environmental impact of Bitcoin mining through technological advancements and policy changes related to halving requires a comprehensive approach.

This approach balances sustainability with the network’s security and decentralization goals. Innovations like renewable energy integration, more energy-efficient mining hardware, and regulatory frameworks promoting eco-friendly practices can mitigate Bitcoin mining’s environmental footprint while maintaining network integrity.

What challenges or opportunities may arise in the Bitcoin ecosystem as the final halving approaches, particularly regarding governance and consensus mechanisms?

As the Bitcoin ecosystem approaches its final halving, the impending event poses both challenges and opportunities, particularly in the realm of governance and consensus mechanisms, impacting network security and decentralization dynamics.

- Governance structures may face increased scrutiny for efficiency.

- Consensus mechanisms could require adaptation to maintain network integrity.

- Network security concerns may arise due to shifting incentives for miners.

Conclusion

In conclusion, Bitcoin Halving is a significant event in the world of cryptocurrency, impacting miners, investors, and the overall Bitcoin ecosystem. By reducing block rewards by half approximately every four years, it regulates the digital asset’s supply and maintains its value proposition.

The implications of the next halving event in 2024 are highly anticipated within the cryptocurrency community, as it has the potential to revolutionize the landscape of Bitcoin and its market dynamics.

![Dogecoin Price Prediction 2050 [Updated] 3 Dogecoin price prediction 2050](https://knowworldnow.com/wp-content/uploads/2022/03/Dogecoin-price-prediction-2050.webp)

![SafeMoon Price Prediction 2023, 2025, 2030, 2040, 2050 [Updated] 4 SafeMoon Price Prediction 2023, 2025, 2030, 2040, 2050](https://knowworldnow.com/wp-content/uploads/2022/09/SafeMoon-Price-Prediction-2023-2025-2030-2040-2050.png.webp)